però una cosa è certa:

visto che tutti ma proprio tutti (con in testa le principali banche di affari)

vi danno il dollaro USA verso la parità con l'Euro

a causa della divergenza/della sfasatura temporale nelle politiche monetarie

=

FED che ha interrotto QE + che sta alzando i tassi

vs.

BCE che ha iniziato QE + che tiene i tassi a zero

allora io vi "posto" una visione CONTRARIAN...giusto per controbilanciare un po'.

Poi vedete voi...

Summary

Typically speaking, a rise in interest

rates should result in a rising dollar, driven by the encouragement of

foreign investment being drawn to the U.S.

While the theory makes sense, however, the

historical results of the past 22 interest rate increases seem to

indicate that the opposite is true.

Based on the data I collected, it seems as

though there's a pretty high chance the dollar is due for a drop,

driven by previous investor overreactions........................

.

Ultimately, this should prove advantageous for certain asset classes if my theory turns out to be correct.

This represents the first such increase since 2006 and, while some investors are likely concerned about the implications, the overall sentiment in the U.S. and abroad has been very positive.

In what follows, I will look at the recent history of interest rate hikes and show that, while theory disagrees with me, investors should look for the value of the dollar to decline after this move, something that would serve to help out exporting businesses in the country further.

A look at conventional wisdom

Before I get into the fun data, let me first talk about the conventional wisdom associated with interest rate hikes so I don't get any hate comments on the bottom of this page about economy theory.

In addition to my Masters in Accountancy, I have a B.A. in Economics so I know a bit about this field. From a purely theoretical construct, an increase in interest rates should push the value of the dollar up relative to all other currencies.

The reason behind this is that, keeping all else the same, a hike in the interest rate will make the dollar more attractive for foreign investors compared to other currencies, enticing them to invest here as opposed to investing elsewhere.

By increasing the demand for dollars, the price rises naturally.

There are a few things to keep in mind here.

The first relates to inflation. As interest rates increase, there is a chance that inflation could rear its ugly head, serving to offset (sometimes by more, sometimes by less) the positive impact of a rise in the value of said currency.

The second issue relates to the lending side of the economy. While a rise in interest rates encourages lending, rates that are too high may discourage borrowing, which could, in theory, stifle economic growth.

Other factors, such as foreign currency changes abroad or other economic conditions, makes it hard to determine what kind of impact a rise in interest rates will have on the dollar relative to other relevant currencies.

Having said all this, however, I think the data points to a scenario where we are very likely to see the dollar fall compared to other currencies over the next year or less.

Looking back in history

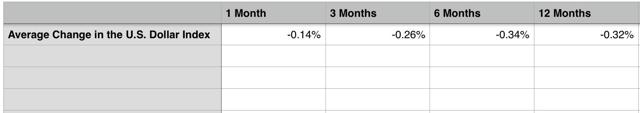

Beginning in 1999, the Fed has raised interest rates a total of 22 times (excluding this most recent increase), according to data provided by the Fed itself. I looked at the situation on each occasion and compared it to the trade-weighted U.S. dollar index spread over four different timeframes; one month, three months, six months, and one year.

What this means is that I tracked the performance of the dollar relative to a basket of currencies associated with our trading partners one month out, three months out, six months out, and a year out.

What I discovered can be seen in the table below.

(click to enlarge)

Based on the data provided, the average return of the dollar following these 22 different rate hikes has been negative one month out, three months out, six months out, and a year out, which indicates that rising interest rates put downward pressure on the dollar.

In addition to the possible reasons I outlined above, one likely explanation for this could be that the dollar tends to increase in anticipation of a rate hike and that, after a hike hits, investors become bearish on the dollar because they knew the anticipation of a hike encouraged other investors to pile into dollars ahead of time.

This, to me, makes the most sense.

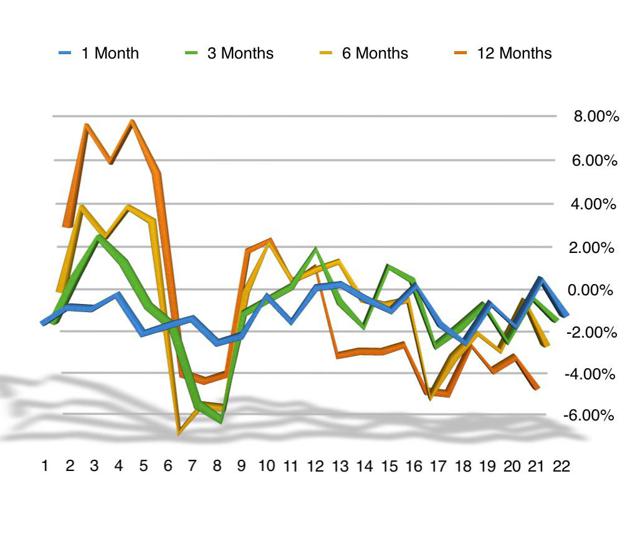

(click to enlarge)

What is interesting, however, is that the data is easily manipulated.

If you look at the graph above, you can see that there have been wild swings following a rate hike, both on the upside and on the downside.

One month out from a hike, for instance, the largest increase in the dollar came out to 1.19%, while the largest decrease was 1.40%.

For one year, the period where swings appear the largest, the greatest increase in the dollar came out to 7.62%, while the largest drop was to the tune of 4.49%.

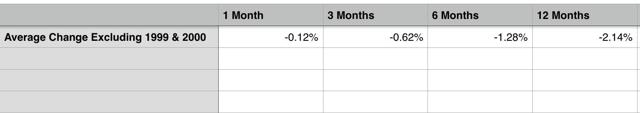

By removing the effects of the rate hikes prior to 2001, for instance, we get a much steeper curve of decline during each of the four timeframes I looked at, as you can see in the table below.

(click to enlarge)

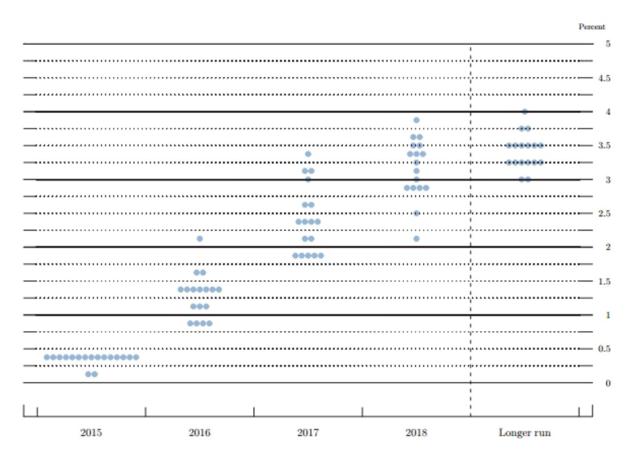

One argument that can be made is that this won't be the only rate hike.

As you can see in the image below, the Fed is aiming for interest rates to hit about 1.375% by the end of next year, implying a rise over the current ceiling of 0.875%.

This means that there should be additional rate increases over the next 12 months which should, in theory, push the dollar up even higher.

However, I suspect that theory will ultimately be wrong on this front.

(click to enlarge)

You see, the notion that multiple interest rate hikes spread out over a condensed period of time will have a high probability of pushing the dollar up hasn't been shown to be the case according to my data. Between 1999 and 2000, five rate hikes occurred.

During 2004, we saw five increases, while 2005 sported eight. 2006 saw four such increases.

In essence, all of the rate increases seen during the timeframe I looked at were condensed to periods of one year or less, so the data I've analyzed doesn't support the stance that this time will be different.

The other issue relates to the value of the dollar today compared to where it has been in the past.

According to the Federal Reserve's U.S. dollar index, the average value of the dollar relative to the basket of currencies in said index resulted in an index value of 108.6597.

As of December 11th, the most recent date the Federal Reserve provided for the index, the number stood at 122.3686.

Of the 240 months looked at, only 31 months had a level where the index stood higher than it is now, which means that it has been higher than today's level only 12.9% of the time.

On top of the dollar already trading fairly high at the moment, only one period of time covered saw the value of the dollar increase above current levels within the next year.

After the rate hikes of 2000, the value of the dollar surged from 115.2333 in January (a month before the first rate hike that year but after two in late 1999) to 127.6703 in July of 2001 (the index hit an all-time high of 129.6882 in 2002).

At no other point in time following a rate hike did the dollar rise so high relative to other currencies that it surpassed where it's at today.

Takeaway

Right now, many investors, primarily those invested in the commodities space like oil, are likely concerned about the impact that a stronger dollar could have on their investments.

While it is very possible that this string of rate hikes by the Federal Reserve could push the dollar higher over the next few months, just as it did in 1999 and 2000, the data seems to indicate that over different timeframes ranging from one month to a year, the average move for the dollar has been lower, not higher, likely due to not only domestic and international economic issues but also due to the probability that many market participants have become overly-bullish on the greenback. For investors like myself, who are positive oil, and for those who are positive export-oriented trades, this should serve as a bullish tone.

.

-------------------------------------

NOTA: Considerando il notevole impegno profuso in Progetti Reali (segui LINK)

capirete meglio perché ABBIA CHIUSO L'AREA COMMENTI DEL MIO BLOG

visto che non ho più tempo né voglia di stare dietro ad un 95% di commenti inutili e di persone che sono professionisti virtuali del commento ma che poi NON si attivano mai realmente.

Per chi vuol commentare rimane la valvola di sfogo della mia Bacheca Facebook https://www.facebook.com/stefano.bassi.758

dove almeno si commenta mettendoci la faccia, nome cognome e chi sei... Rilancio sempre i miei post del BLOG nella mia Bacheca Facebook.

Invece per chi vuol commentare ma soprattutto partecipare attivamente ai progetti in corso c'è la mia e-mail lagrandecrisi2009@gmail.com

-----------------------------------------

PER UN BLOG E' MOLTO IMPORTANTE CHE FACCIATE ALMENO LO SFORZO MINIMO DI CLICCARE SUI TASTI SOCIAL "MI PIACE", "TWEET" ETC CHE TROVATE QUI SOTTO...GRAZIE.

(sul sostegno attivo - donazioni/pubblicità - già conoscete alla nausea il mio punto di vista...)